The proposed merger between Kroger and Albertsons, the largest grocery store consolidation in U.S. history, is now under intense scrutiny as it moves to federal court. The $24.6 billion deal, announced in October 2022, aims to create a more formidable competitor in the grocery sector. However, this plan is encountering significant resistance from antitrust regulators.

On one side of the dispute are Kroger and Albertsons, two of the largest supermarket chains in the United States. They argue that merging would strengthen their position against rivals such as Costco and Walmart, which dominates approximately 22% of U.S. grocery sales. The combined entity would control around 13% of the market. The companies assert that the merger would enable them to leverage better supplier deals, reduce prices, and enhance their store brands.

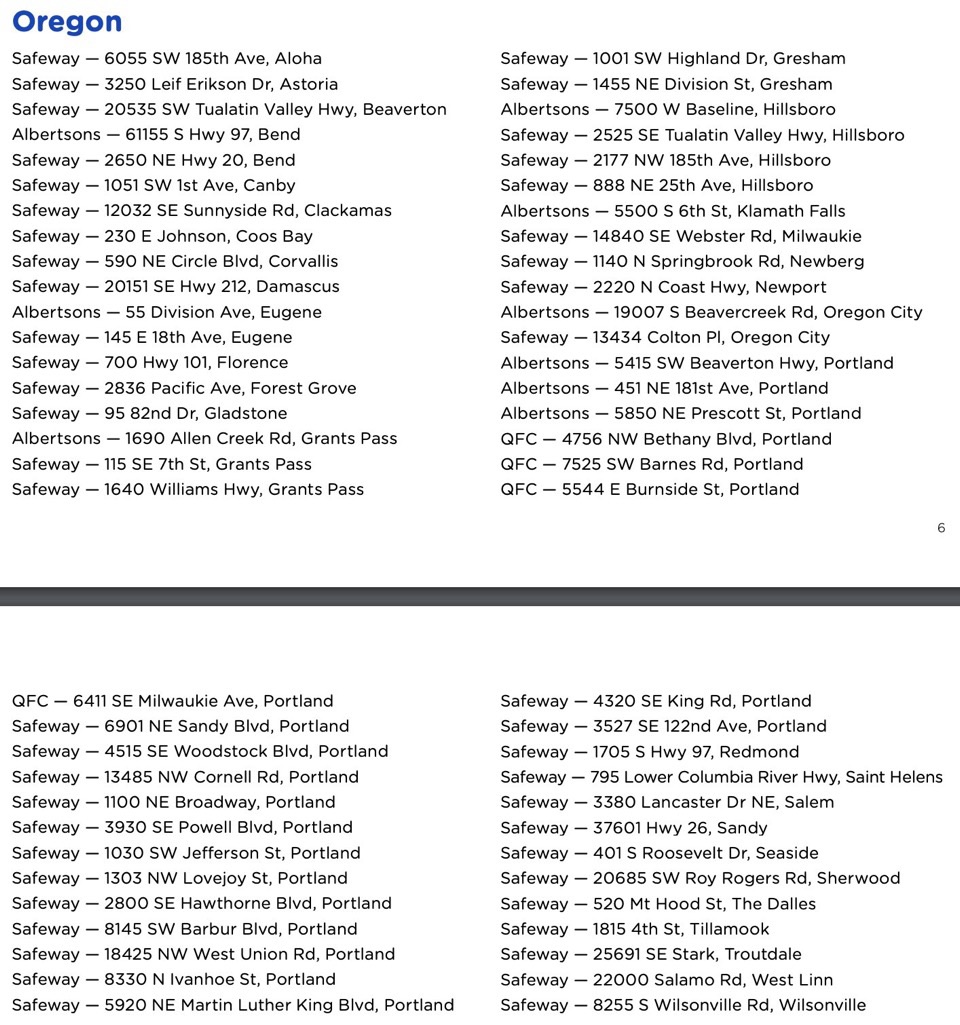

On the other side is the Federal Trade Commission (FTC), which contends that the merger would stifle competition, leading to higher prices, reduced quality, and lower wages for workers. The FTC’s concerns are reflected in its February complaint seeking to block the merger through an administrative judge. The Commission has also filed for a preliminary injunction in federal court in Oregon, where a district judge is expected to hear arguments starting Monday. This injunction would temporarily halt the merger while the FTC’s in-house review proceeds.

Legal experts anticipate that if the preliminary injunction is granted, Kroger and Albertsons will likely appeal the decision to a higher court. Mike Keeley, a partner and antitrust chair at Axinn, Veltrop & Harkrider, a Washington law firm, notes that the case could then traverse through the FTC’s judicial system, which can be a lengthy process. Companies often reconsider their deals when faced with extended delays.

In a related legal maneuver, Kroger has sued the FTC, challenging the constitutionality of the agency’s internal proceedings and arguing for the merger’s merits to be judged in federal court. This lawsuit, filed in Ohio, draws on a recent Supreme Court decision that curtailed the Securities and Exchange Commission’s authority to adjudicate certain civil fraud cases internally.

The legal battle is further supported by a coalition of state attorneys general from California, the District of Columbia, Illinois, Maryland, Nevada, New Mexico, Oregon, and Wyoming, who have joined the federal lawsuit against the merger.

As this high-stakes case unfolds, the outcome could significantly reshape the U.S. grocery landscape, affecting consumers, competitors, and the broader market.